OUP acquires Karger's long tail

Industry consolidation continues

Hello fellow journalologists,

The most significant news story this week was the acquisition of medical publisher Karger by Oxford University Press. In today’s newsletter I’m going to assess the implications of this development for the two portfolios and for the wider (journals) publishing industry.

I’ll send a round up of this week’s news in a separate email in a few days.

Let’s kick off with a quote from the press release to set the scene:

Oxford University Press (OUP) has signed a definitive agreement to acquire Karger Publishers. The transaction is expected to complete in December. Following closing, this acquisition will see OUP welcome Karger to its wider organization, bringing together a shared commitment to quality and scholarly integrity, and extending the reach and impact of Karger’s leading academic and research publishing in medicine and health sciences.

Karger is a family owned publishing house, founded in 1890, that has around 100 journals, mainly covering the biomedical and clinical sciences. It also has a backlist of 9000 books, 189 online courses, and the recently launched Karger Impact Support Services, which “enables your institution to tell your research story” (Karger acquired Research Publishing International in 2022).

This newsletter is called Journalology, so the Karger journals portfolio, and the possible synergies with OUP’s journals programme, is where I will focus my attention today.

What does the Karger portfolio of journals look like?

Last year Karger published 4400 research and review articles in just shy of 100 journals. By contrast, Oxford University Press, its soon-to-be owner, published 53,000 research and review articles in 2024, in just over 500 journals. Adding Karger will boost OUP article volumes by around 8% and the number of journals by around 20%.

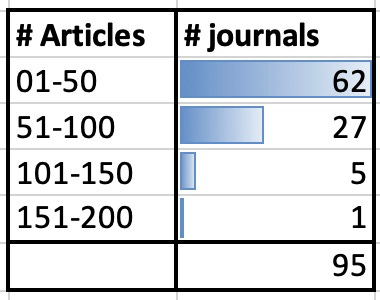

The Karger portfolio is made up of small journals. Around two-thirds of the journals published fewer than 50 research and review articles in 2024, according to Dimensions (Digital Science).

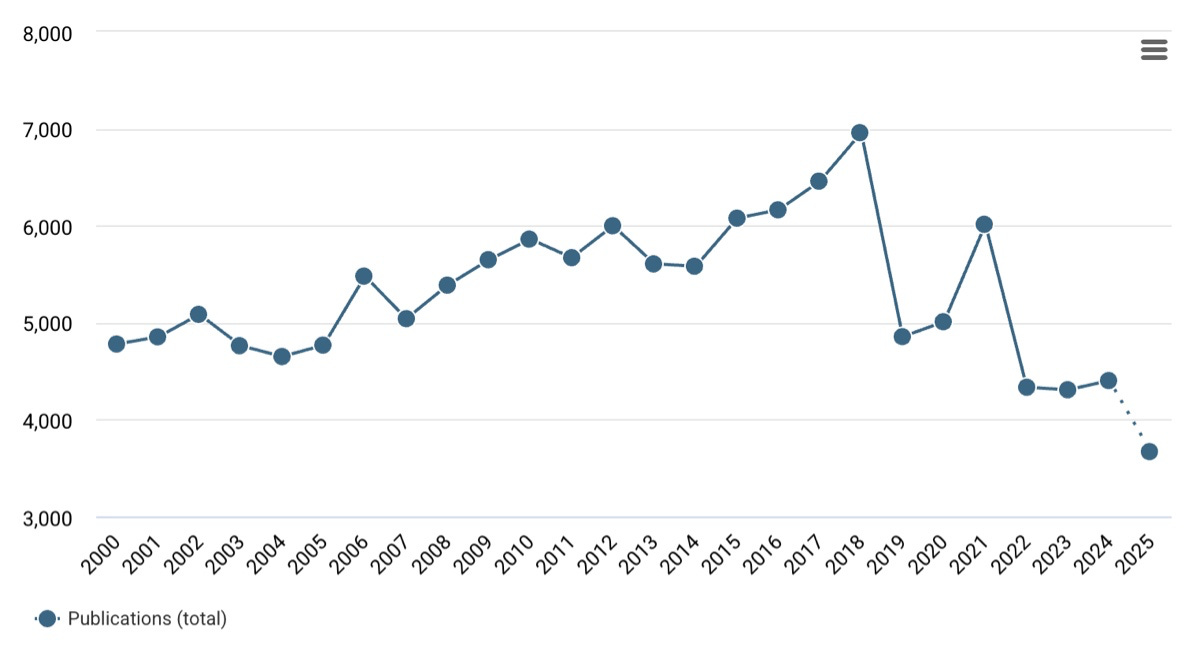

Article volumes in the Karger portfolio have held relatively steady over the past 25 years.

The increase in 2018 (and fall in 2019) is due, in large part, to one journal, Cellular Physiology and Biochemistry, which grew rapidly off the back of submissions from China, but had problems with paper mills; it is no longer published by Karger. The dotted lines for 2025 represent the year-to-date article volume.

How will the acquisition affect OUP’s market share?

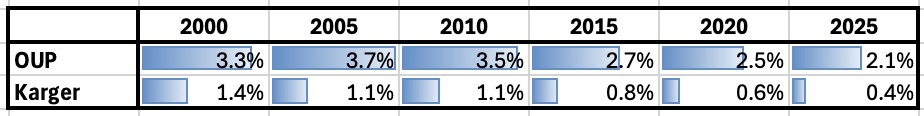

Global article output (all publishers) has increased rapidly in recent years, which means that both Karger’s and OUP’s market share has decreased over time. The table below shows the two publishers’ market share of the “Biomedical and Clinical Sciences” ANZSRC 2020 category (most of Karger’s output sits in this category) over a 25-year period.

Between 2000 and 2025 Karger’s market share dropped from 1.4% to 0.4% and OUP’s fell from 3.3% to 2.1%. Acquiring Karger will bring OUP back to where it was in 2020, but it will still be significantly behind the high point of 20 years ago.

The sad truth is that in today’s scholarly publishing market scale wins. Perhaps the Karger family felt that now was a good time to exit and give their journals (and other products and services) the best chance to thrive under a new, larger, owner.

Hybrid OA and transformative agreements

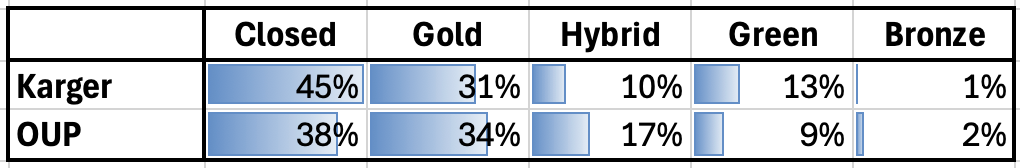

The table below shows the proportion of access types in 2024 in the biomedical and clinical sciences for the two organisations.

The difference in hybrid percentages may be due to the fact that Karger has 28 transformative agreements listed in the ESAC transformative agreement registry, whereas OUP has 64. (N.B. The ESAC registry is based on self reporting by participating institutions and may not provide an accurate view of the transformative agreement landscape.)

Transformative agreements help publishers to attract content, as some researchers will choose to submit to journals that offer open access “for free” through their institution’s transformative agreement with the publisher. The OUP management team may reasonably expect the Karger journals to receive more submissions once they are included in OUP’s transformative agreements.

What will the combined portfolio look like?

The next table shows the number of research articles and reviews published in 2024 for each of the two publishers. OUP publishes relatively few papers in the physical, chemical and applied sciences; this acquisition adds to its core strengths rather than expanding it into new areas.

The challenge for OUP will be to grow Karger’s portfolio of small journals. A long tail of small journals can become an opportunity cost; it’s a lot easier (and cheaper) to manage one journal that publishes 5000 articles a year than 100 journals that each publish 50 articles a year. Furthermore success breeds success: large journals tend to attract more submissions than small journals, helping them to grow quicker.

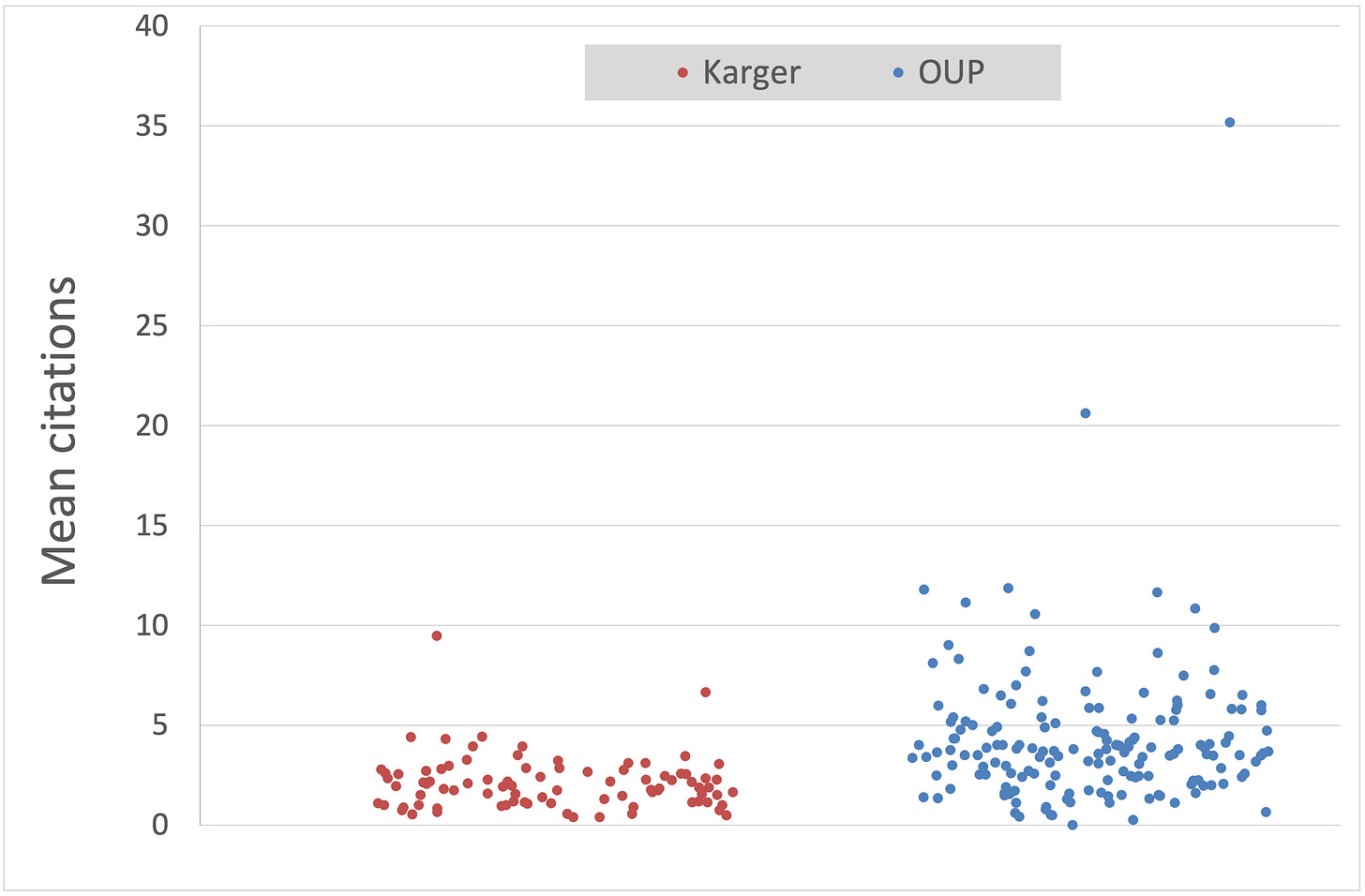

So why did OUP decide to acquire Karger? The following scatter plot may help to explain at least some of the appeal. Each dot on the graph represents one journal. The red dots are Karger journals and the blue dots are OUP journals (in the biomedical and clinical sciences). The y-axis is the mean number of citations to articles published in 2024.

For example, the blue dot at the top of the graph, sitting on the “35 mean citations” line, is the European Heart Journal, which is published by OUP on behalf of the European Society of Cardiology; articles publish in the EHJ in 2024 have been cited, on average, 35 times to date.

As you can see from the scatter plot, all bar two of the Karger journals sit below the “5 mean citations” horizontal line. OUP, by contrast, has a large number of biomedical and clinical journals that sit above that line.

Acquiring the Karger journals will provide OUP with many more downstream transfer destinations, helping OUP to publish more of the articles that get rejected by their higher impact journals. This is how a portfolio strategy works: the sum is greater than the parts.

Implications for the wider industry

The acquisition of Karger by OUP is another example of consolidation within scholarly publishing. A few months ago David Crotty (who, it was announced this week, will soon become the new executive director of the Cold Spring Harbor Laboratory Press), wrote an update on Quantifying Consolidation in the Scholarly Journals Market for The Scholarly Kitchen. David wrote:

Between 2018 and 2024, the 5 largest publishers saw their market share grow by 9%, from 52% to 61% of the total market. The 10 largest and 20 largest publishers saw similar gains, growing 10% and 8% in six years.

According to Dimensions, OUP is ranked 11 in terms of article volumes in 2025. The Karger acquisition will help it to close the gap with Wolters Kluwer, ranked 10, but not overtake it, at least initially.

However, OUP may be able to grow submissions to the Karger journals by (a) rolling out transformative agreements to Karger journals; and (b) transferring rejected articles from higher impact OUP journals downstream to the Karger portfolio.

Finally, it’s worth acknowledging that employees at both organisations will be experiencing a period of uncertainty right now. Acquisitions can result in layoffs, as the buyer seeks to reduce costs and generate economies of scale. Some former employees of Mary Ann Liebert, which was acquired by Sage this time last year, learned this the hard way. If you are affected in future months and need advice or support, please reach out to me. I’d be happy to help if I can.

Until next time,

James